20+ Home refinance rates

At Bankrate we strive to help you make smarter financial decisions. Refinance options are the same as for mortgages to purchase a home including conforming VA FHA and jumbo mortgages with terms of 15- or 30-year fixed-rate loans or 5-year ARMs.

Volume Of Home Purchase And Refinance Originations And Average Prime Download Scientific Diagram

Historical mortgage rates chart.

. Home loan comparison Home loan rates continue to rise but you can still find rates as low as 314. 20 Down Payment in Maryland. Ideal Credit Union offers a full suite of mortgage products to help you buy a new home refinance your home and more.

Refinance rates are very competitive with other mortgage lenders. Requires a 20 deposit. Minimum Down Payment in Maryland 3 11700.

Cost to refinance your home. Having 20 equity in your home before you refinance your mortgage is ideal although you can qualify with less equity. Average for 2022 as of August 26 2022.

This saves money on interest costs for the borrower. The refinance rates shown assume a few basic things including. What this means.

How much cash you can pull out of your home with a cash-out refinance depends on how much home equity you have. Expect your rate to be about 0125-025 percent higher than the standard refi rates youd qualify for. On Wednesday September 7th 2022 the average APR on a 30-year fixed-rate mortgage fell 6 basis points to 5948The average APR on a 15-year fixed-rate mortgage fell 9 basis points to 5107 and.

Save MoneyIf a borrower negotiated a loan during a period of high interest rates and interest rates have since decreased it may be possible to refinance to a new loan with a lower interest rate. Fixed - No Lender Fee - Conventional. 20-year fixed rate mortgage.

A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out at closing and change your loan term to 5 10 15 or 20 years. Average Home Sale Price in Maryland 1. The average APR for a 30-year fixed refinance loan decreased to 605 from 607 yesterday.

Fannie Mae and Freddie Mac require mortgage insurance for borrowers. The average 20-year refinance APR is 6150 according to Bankrates latest survey of the nations largest mortgage lenders. You will purchase up to one mortgage discount point in exchange for a lower interest rate.

Tapping your home equity to make home improvements consolidate debt or buy a. Compare todays refinance rates from trusted lenders and see how much you can save. Having at least 20 equity will help you get the lowest refinance rates.

This is one of the most widely known and used ways to get financing for a mobile home because they do not require you to own the land the home is on. Mortgage interest rates have been volatile throughout the summer and. 3288 refinance cashback offer.

Current Mortgage Refinance Rates for September 2022. See competitive home equity rates from lenders that match your criteria and compare your offers side by side. Your loan is for a single-family home as your primary residence.

Average Credit Score in Maryland 2. Lenders will typically require you to keep at least 20 equity in your home. The biggest problem with a chattel loan is the very high-interest rates and short.

Lowest investor variable rate. At least 15 percent to 20. Comparison rate on the Gateway Bank Low Rate Essentials Home Loan for LVRs.

Payments are still required after 20 home equity is reached. Youll need to have a credit score of 740 or higher and have enough equity in your home at least 20. What this means.

You have very good credit a FICO Score of 740 and at least 20 equity. Learn more about mortgage refinancing. This can be circumvented by.

Call us at 651-747-4663 or Make an Appointment for rates and to learn more. HELOCs have variable rates. The monthly payment reflects both the repayment for the cash out at closing and your monthly mortgage payment.

This is a very useful offer If you agree to a variable rate your interest may rise. How to get the best refinance rates. Does cash-out refinancing have higher interest rates.

Usually the down payment is 5-20 the terms are usually 20-30 years and the rates are around 5. Comparison rate on the Australian Mutual Bank Basic Variable Home Loan for LVRs. This time last week the 30-year fixed APR was 597.

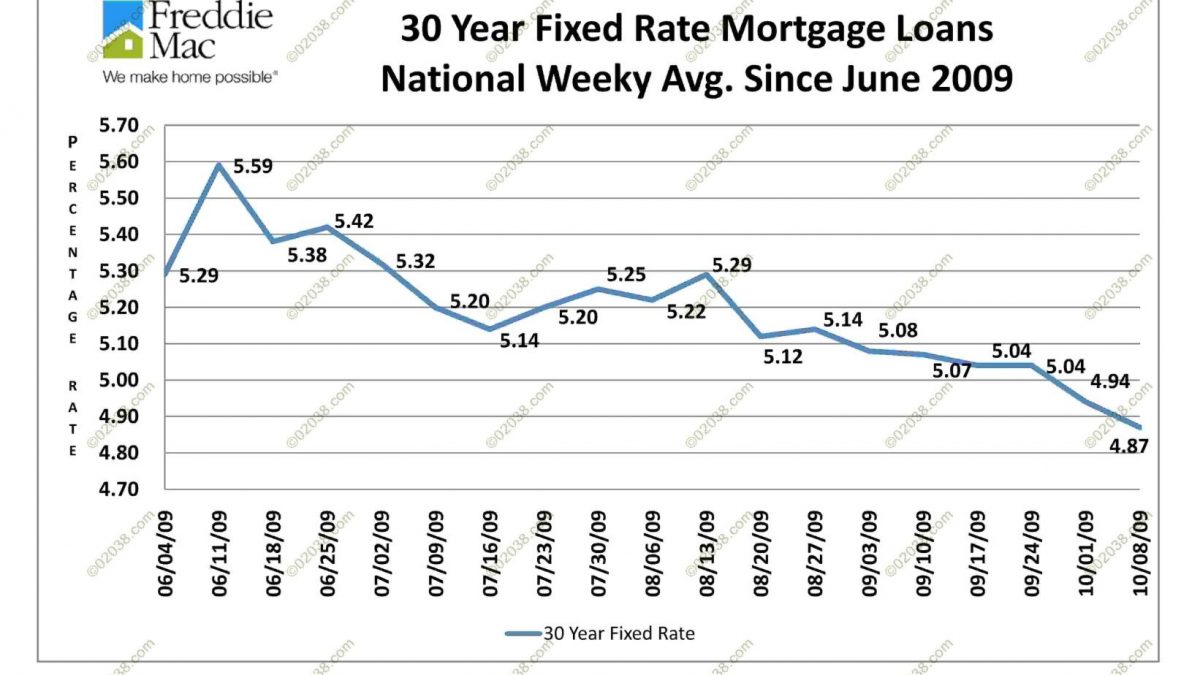

Chart represents weekly averages for a 30-year fixed-rate mortgage. Although 30-year mortgage refinance rates held steady at 5125 since yesterday homeowners looking for a combination of a lower interest rate and smaller monthly mortgage payment. Rates for a 30-year refinance hit 5875 over the weekend the highest theyve been since the end of JulyMeanwhile 20-year rates fell slightly and 10- and 15-year rates held.

Todays Mortgage Refinance Rates. Nationstar HELOC product offers competitive rates as well as the ability to fix the rate to protect yourself from future interest rate increases. How to read our rates.

Go to site More Info. Refinance home loan rates of note in September. 15- or 20-year term.

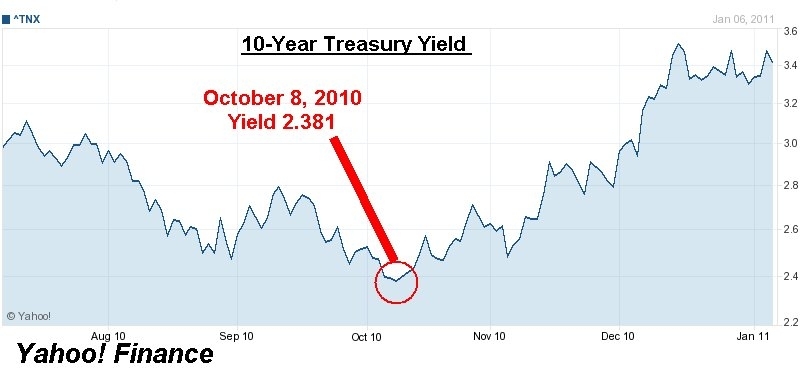

The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac. Paying off an adjustable-rate mortgage ARM before the ARM rate and payment adjusts higher than current 30-year rates. On Tuesday September 6th 2022 the average APR on a 30-year fixed-rate mortgage rose 2 basis points to 5999The average APR on a 15-year fixed-rate mortgage fell 5 basis points to 5191 and.

Other considerations when picking a refinance rate product. Homebuyers will typically have to make a down payment equal to 20 of the homes value. USAA offers a full range of mortgage refinancing options including cash-out refinancing.

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

Explore Our Image Of Periodic Inspection Report For Rental Property Template Inspection Checklist Checklist Template Home Inspection

Hsbc Fixed And Variable Mortgage Rates Sep 2022 From 4 94 Wowa Ca

What Is A Tracker Mortgage Moneymantv Mortgage Advice In The Uk Interest Only Mortgage Mortgage Advice Mortgage Brokers

Pin On Tamara Torkelsen Gateway Mortgage Group

House Hacking Eliminate Your Housing Expense Using Other People S Money Living On The Cheap Other People S Money Home Hacks Using People

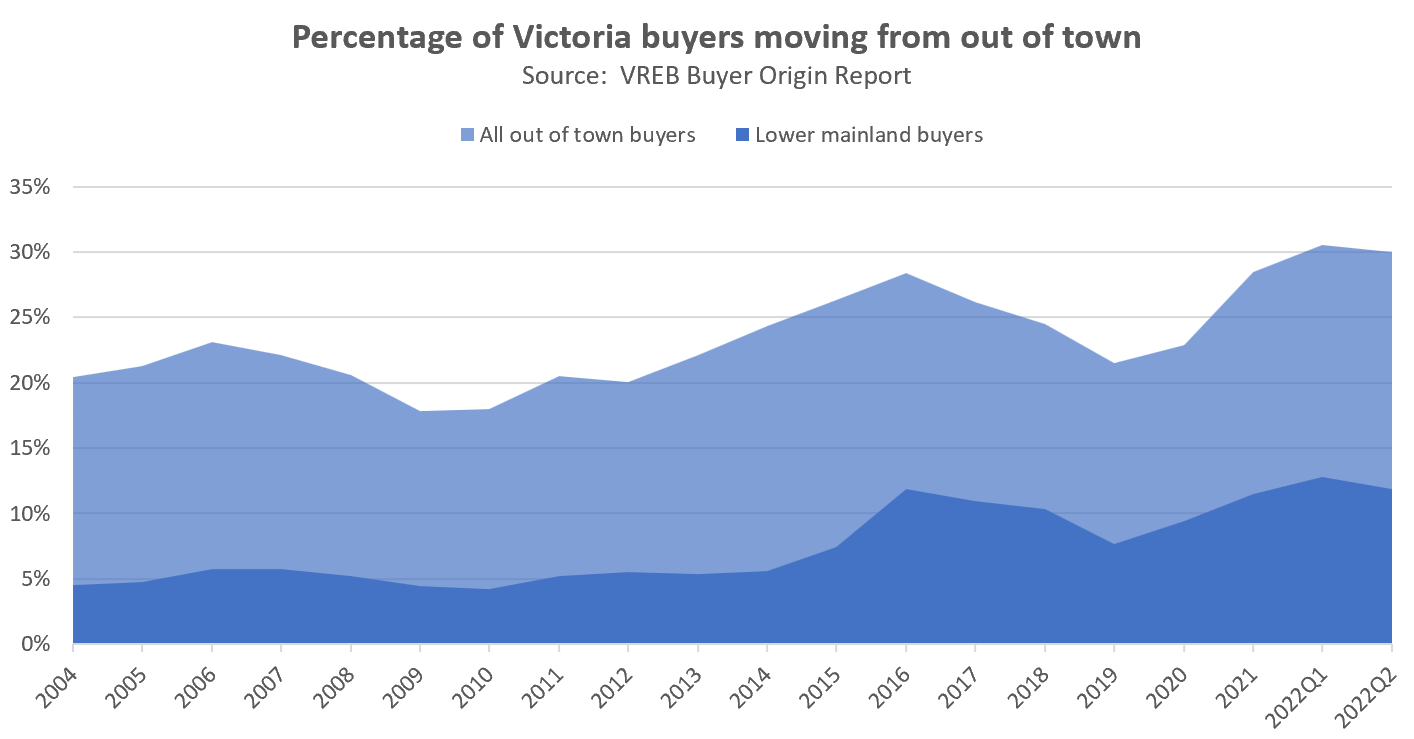

The Three Horses Of Housing Demand House Hunt Victoria

Should I Go With A Mortgage Broker Or A Bank Mortgage Rates Mortgage Mortgage Brokers

Mortgage Rates Near Record Lows 02038 Real Estate

Housing Market Replace What The Fed Meeting Manner For Mortgage Costs In 2022 Mortgage Marketing Mortgage Advice Marketing Consultant

How To Buy A House Step By Step Real Estate Infographic Home Buying Real Estate

Breaking Down Monthly Payment Estimates For Borrowers Mortgage Payment The Borrowers Mortgage

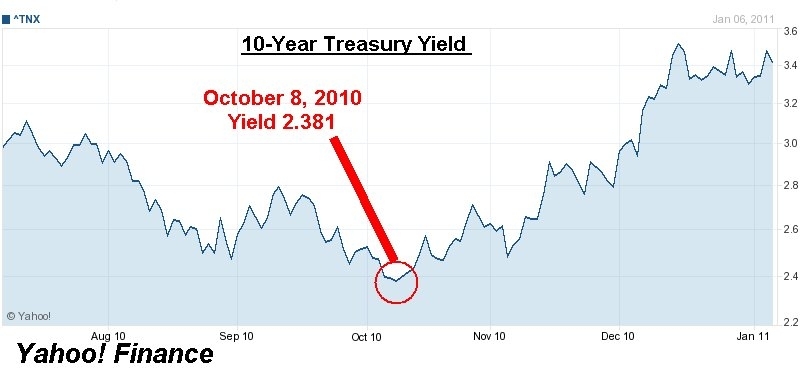

Using Tbt To Protect Against Mortgage Interest Rates Nysearca Tbt Seeking Alpha

Common Questions About Reverse Mortgages Part 4 Reverse Mortgage Mortgage How To Get Money

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Line Of Credit Tracker Line Of Credit Personal Financial Statement Student Loan Interest

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates